Three upgrades to complete Europe's Hamiltonian moment

The 'midterm evaluation' of the European Recovery and Resilience facility

Based on Francesco Grillo's column for the Italian newspaper Sole24ore.

We need €500 billion per year. This is the estimate of the investment needed by Europe to complete the two great transformations that must lead the continent into the future and that are necessary to escape its progressive marginalization compared to more dynamic continents. This estimate, from the former governor of the European Central Bank Mario Draghi, warns that a strong re-evaluation of fiscal and monetary policy tools is needed. The Union will need a permanent fiscal capacity that starts from the great innovation conceived in May 2020, at the summit called to respond to an emergency – the COVID19 pandemic - that no one had foreseen. However, we cannot propose the scheme of the Next Generation EU (NGEU) (the mechanism of which the Recovery and Resilience Facility – RRF – was the largest part) without an evaluation of its merits and limitations.

Undoubtedly, the project has been successful because it has "broken a glass ceiling" (the taboo on common debt), as Economic Affairs Commissioner Gentiloni said when presenting the "interim assessment" of the RRF a few days ago. The plan has got three merits. The first was to send the strong signal that the EU was getting together in its own darkest hour: the signal that was missing twelve years ago, before the European Central Bank had to intervene to save the Euro with unconventional weapons. It is also evident that the plan is proceeding more rapidly than the older cohesion policies (the traditional development instrument on which the Union relies to reduce territorial and social disparities). Thirdly, the idea of linking payments to the implementation of reforms addressing structural inefficiencies is working.

However, certain statements appear optimistic but three elements remain unframed by the radar of a debate that should concern everyone.

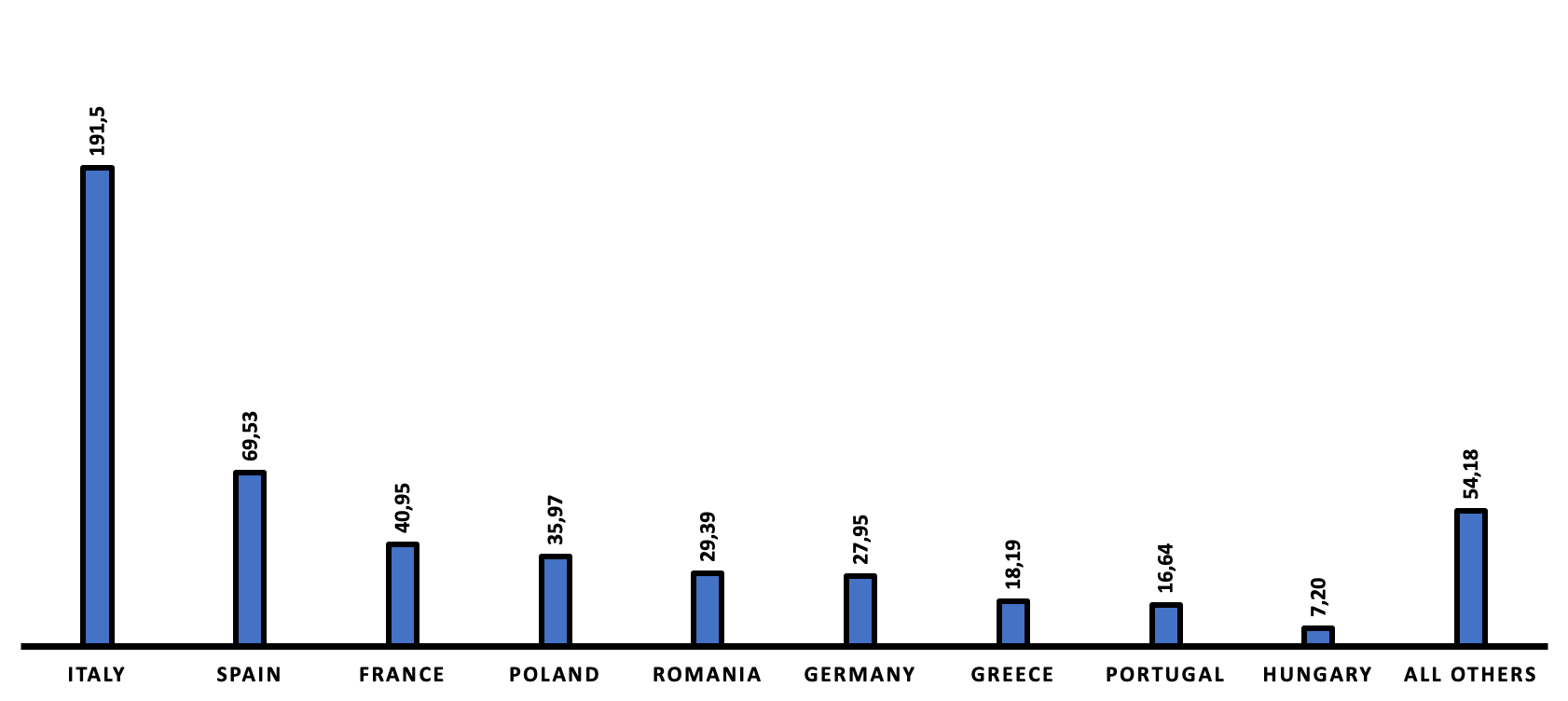

Firstly, the impact on GDP. According to the "interim assessment," the EU's GDP could increase by 1.4% in 2026 thanks to the RRF alone. These are not small impacts but are possible considering that NGEU is worth, overall, 3% of the European GDP. And yet, this impact is not yet visible: in 2025 the Union's economy is expected to grow by 1.7% (in a context assumed to be again with inflation close to 2%), lower than the 2.2% the Union recorded in the five years before the pandemic. It is certainly possible that the RRF is simply avoiding a frightening recession; and yet, there are greater doubts considering the country that benefits most from European funds. Currently, Italy accounts for almost 40% of the total resources (Figure 1), and on Italy's GDP, the Resilience Fund accounts for almost 10% of GDP; on the overall GDP of the Union, the RRF accounts for just over 3%. This would give an advantage in terms of Italian GDP growth compared to the EU average, of about 1.5 percentage points per year; and yet, in the period between 2022 and 2025, according to Commission forecasts, Italy grows - in the years of Next Generation EU - slightly less than the EU average (although it reduces a gap that has lasted for twenty-five years).

FIGURE 1 RECOVERY AND RESILIENCE FACILITY, FUND REQUESTED BY COUNTRY (AS OF FEBRUARY 2024, BILLION €)

SOURCE: VISION ON EUROPEAN COMMISSION DATA

The second doubt about the evaluation of Next Generation EU concerns the issue of payments. It is an issue that can explain the persistent weak impact on GDP. When the European Commission reiterates that they are in line with expectations, it refers to the resources transferred from the Commission to the Member States. It is true that Italy, for example, received by the end of 2023 half of the planned resources; however, according to the State General Accounting Office, only 10% of the total planned for the entire PNRR has landed in the accounts of the beneficiaries (businesses and families). The entire implementation phase suffers, naturally, from times that can only be lengthened by bidding and project times. Of course, the RRF focuses heavily on procurement and administration reform, and yet the challenge is still to change the team while trying simultaneously to win the toughest game.

Finally, the famous "milestones" and "targets". The best insight of Next Generation EU was to make payments depend not on the reporting of investments to be reimbursed (as for structural funds) but rather on the achievement of certain results. However, there is an evident difficulty in achieving not the "milestones," which normally correspond to the completion of procedures enabling RRF spending, but instead in the meeting of deadlines of the harder "targets" that measure the completion of investments. According to the interim assessment, out of 324 planned targets between 2021 and 2022, only about one-fifth had been achieved, and this could pose a challenge in completing the plans by June 2026 (the final date by which investments must not only be completed but also tested and open to the public).

In relation to these critical issues, three hypotheses for improvement emerge, which the European Commission itself seems to take seriously, considering the experimental nature of a newly born tool.

Firstly, greater flexibility and a time frame of at least one programming cycle are necessary (seven years, whereas the RRF lasts five): a shopping list does not work because recent history shows that just moving from 2020 to 2024, we have gone from one era to another. Secondly, the mechanism of "milestones" and "targets" must be confirmed but also revised, identifying among the parameters to be achieved those on which policy makers and public opinion should focus (introducing, moreover, a system to monitor when spending reaches the real economy).Finally, even on the reforms that are essential, a way must be found to go beyond the moment of approval of a specific law and to move even more towards the control of results appreciated by citizens (reducing waiting times in a court or a hospital, for example).

"We sail in oceans for which we do not have the map", Mario Draghi in 2014 admitted that we are trying to govern crises never before seen that challenge the governance and reading tools we used for a more stable world. Today, to save Europe, we must succeed in investing not only resources but also in studying to conceive completely new tools without wasting time in timeless clashes between those who would like more or less of Europe. Simultaneously however, we need a Union that lands in a century that has caught it by surprise.

This article is an elaboration of column written by Francesco Grillo for the Italian newspaper Sole24ore, and Radi Damianov.