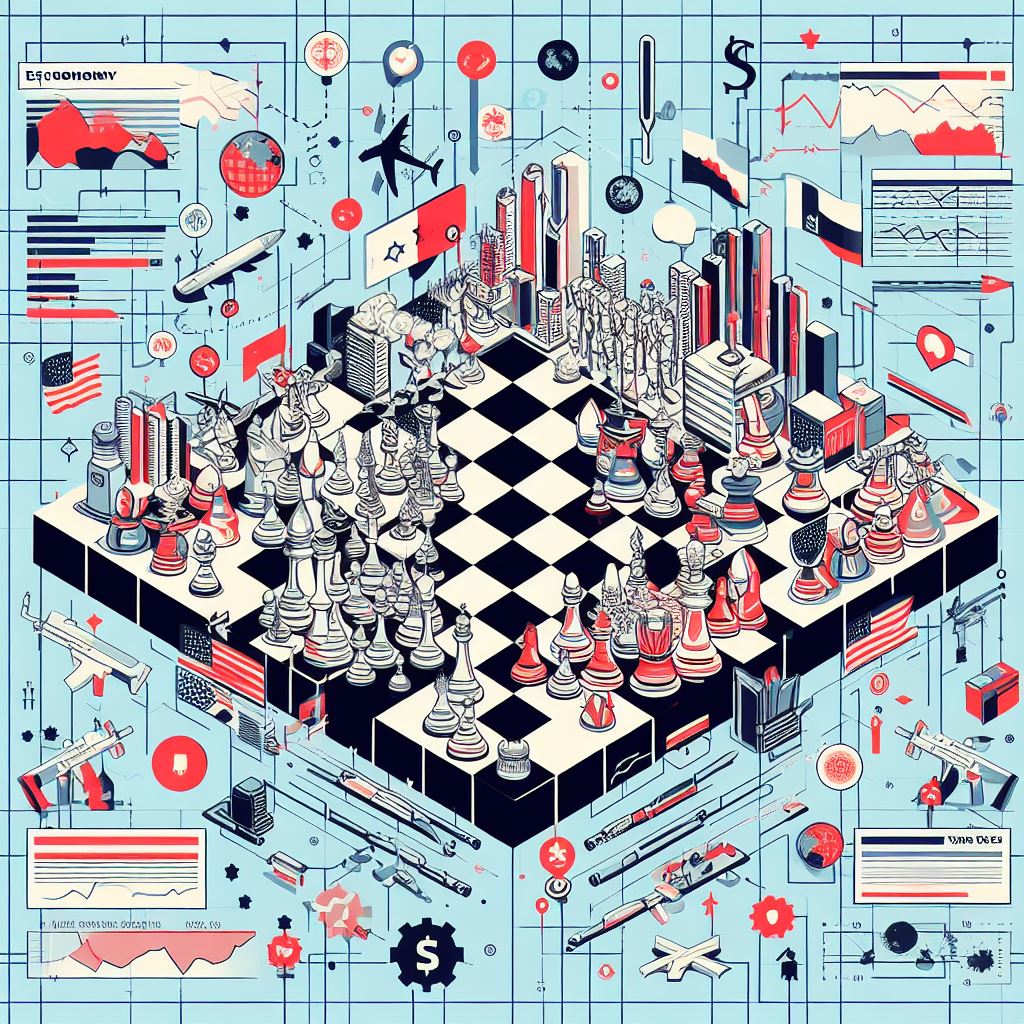

Israel and Gaza, it is not only about geopolitics.

The economic aspects need to be fixed as well to secure peace.

Article by Enrico Calderini.

The Palestinian economy is one of the most fragile in the world. Unemployment in Gaza was reaching almost fifty percent of the population before the war. Such economic situation became a fertile soil for Hamas.

The other economies of the area were also under pressure before the war, and now are very exposed.

The relationship between Israel and Palestine is, since decades, one of the main geopolitical problems in the world. However, it is not only about geopolitics. The economic aspects are playing a critical role as well, and they will need to be fixed, as much as possible, in some way. Palestine is economically extremely fragile, even before the current escalation. Economic activity is hampered by restriction of movement of its population, including the notorious 730 km long wall built during the 2000s. Only 200,000 Palestinians can work “legally” in Israel (but additional 200,00 are working unofficially). The Palestinian Authority is not controlling in full its fiscal revenues: two thirds of state proceeds are collected by Israel and given back, after some (relevant) deductions, to the Palestinian Authority (PA). Donor funding collapsed during the last years (from 10% to less than 1% of GDP). The PA is not receiving any fiscal revenue from a large part of the Palestine territory, which is partially out of its control. Public sector employees do not always receive in full their salaries: sometimes the PA decides to curtail their salaries as it has no money available. Without a functioning state and a functioning economy, and with no money to be invested in the future of the young generations (ie. education, health, availability of water and other basic infrastructures), there cannot be hopes for the decades to come.

Gaza represents a special situation. It is an enclave which is, since 15 years, out of the control of the Palestinian Authority. The economic performance of Gaza has been significantly worse than the one of West Bank. Unemployment in Gaza is three times higher than in the West Bank and reaches almost half of the population. Many basic services in Gaza, are provided by UNRWA, which also found itself in serious financial difficulties during the last years. UNRWA became in Gaza the main provider of food, health and education. UNRWA provides public goods despite it is not a state, and without any possibility to collect revenues.

On the other hand, the Israeli economy is very solid. Israel, the “startup nation”, is having strong institutions, and it is highly rated by the main rating agencies (various notches higher than Italy and Greece for instance). It benefits from a specialization in the high-tech sector and high investments in education (spending in education and in Research and Development per capita ratios are among the highest in the world). During 2022 and 2023 it suffered the global slowdown in venture capital flows, and in investments in IT. The war may further accelerate such trends. The effects of the war will be visible also for other reasons: a large part of Israeli workers (more than 350 thousand) is now serving as reservists in the Army, many of them ready to enter Gaza, and this will have an impact on the economic activity. Moreover, spending in defense will probably increase, weighting on the Israeli deficit by various percentage points.

At the same time, the economies of the region, especially Egypt, Lebanon and Syria, are extremely weak and highly exposed to the additional shocks deriving from the war, following the Covid-19 (which heavily affected tourism and all other economic activities), the Russian aggression to Ukraine, the increase of energy and food prices (especially wheat) and the consequent inflationary pressure. With high inflation of food and energy, social stability is at risk. However, these countries cannot only blame the repeated crisis. The years which followed the Arab springs of 2010-11 have been very disappointing in terms of economic performance for the entire region (apart from Israel). It was a “lost decade”, and left such countries with high public debt and low economic growth. Especially, drivers of long-term growth seems to be inadequate – another economic problem to be fixed. Lebanon went in default few weeks before the eruption of Covid-19, at the beginning of 2020. The never-ending political crisis – still there is a caretaker government and no president – suggests that the country will not be able to exit the political and economic crisis soon. The role of Hezbollah, partnering with Hamas and Iran, is an additional source of instability. Egypt, the largest economy in the region, is trapped in a dangerous spiral: high debt, high inflation (surpassing 35%), weaker currency, higher country risk, disagreements with the International Monetary Fund. Egypt recently collected two rating downgrades in few days. Jordan is also very exposed, given its dependence on tourism and the fact that a large part of the population is of Palestinian origin.

In summary, a political solution, especially related to the future management of Gaza following Israeli actions in the Strip, must come first. But, immediately after, the economic problems must be tackled, having in mind a long term perspective (especially related to the needed progresses in education and productivity). To have peace, we need functional economies and robust economic policies, focusing on the long-term drivers of growth.