Europe's Third Way

There is a way to resolve the (false) trade off between values and efficiency.

Paper anticipated by article published by Il Messaggero

For two centuries, Britain’s intellectual elite—those who’ve wielded cultural hegemony—have had a complicated relationship with Europe. On the one hand, they admire what Britain lacks: a longer and deeper historical narrative (English history, by comparison, begins with Elizabeth I); a national cuisine that rivals that of the Chianti hills; or the ability to win at sports—like football—which, ironically, they themselves invented.

Yet, alongside this admiration lies a subtle mischief: a certain intellectual energy spent designing clever traps seemingly meant to keep Europe from rising again—so close to the cliffs of Dover. The Economist’s weekly column on Europe, pointedly titled “Charlemagne” (after the first ruler to unite the continent), perfectly reflects this contradiction. It praises Europe’s deliberate pace as a counterpoint to the chaotic speed of the United States—but risks pacifying a continent that desperately needs to accelerate.

Stanley Pignal of The Economist is right to suggest that the decline of the United States—possibly hastened by the theatrics out of the White House—may allow the battered stars of the European Union to shine again, albeit discreetly. After all, the "wealth of nations" is a relative concept. As shown by recent credit rating upgrades for Italy, economic strength is assessed not in isolation, but in comparison with others.

The Global Economic Landscape Is Shifting

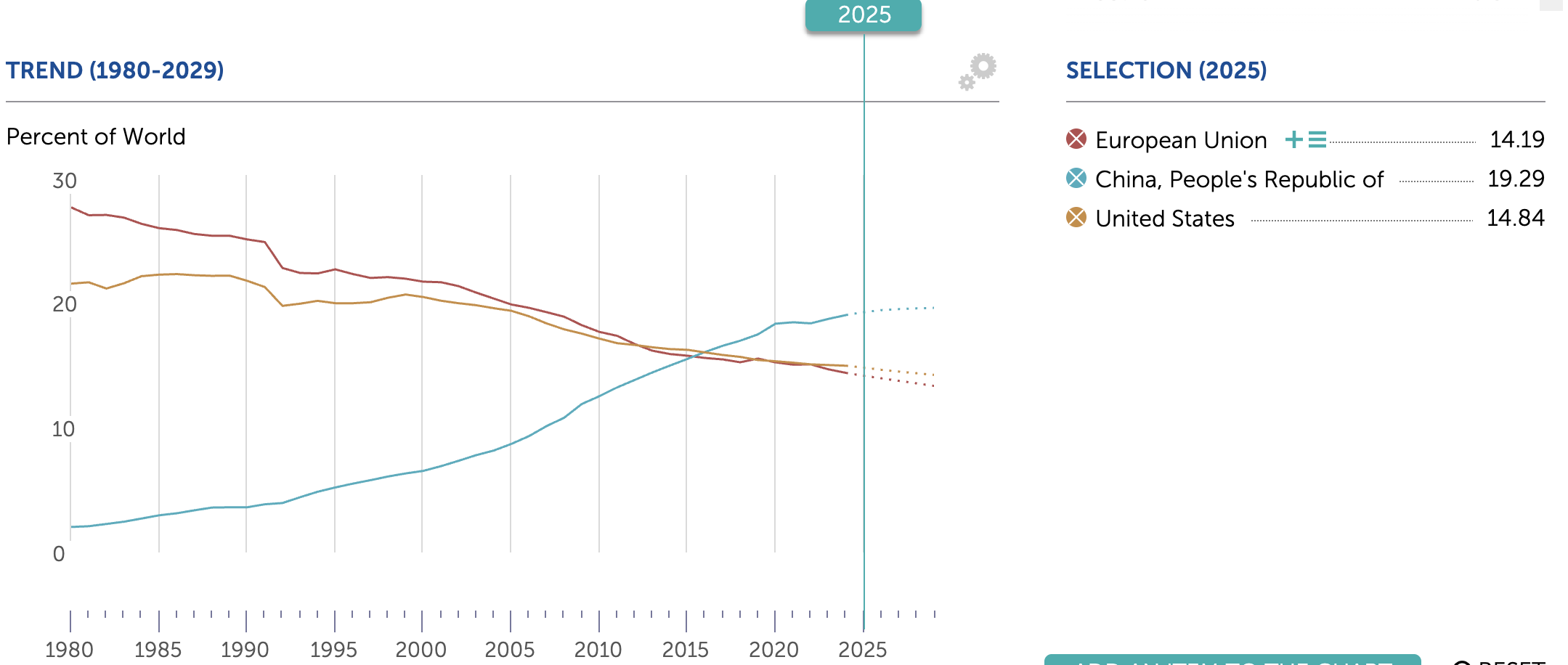

To better understand the shifting dynamics in global economic power, it’s useful to examine the changing distribution of world GDP among the three major blocs: the European Union, the United States, and China. The following graph traces their respective shares from 1980 to the present, with projections through 2029.

Figure 1. Share of Global GDP (1980–2029)

Over the last four decades, the share of global GDP held by both the EU and the U.S. has gradually declined, while China’s has risen sharply. In 2025, China is projected to account for 19.3% of the global economy, compared to 14.8% for the U.S. and 14.2% for the EU. (Source: IMF, (2024))

This trend reveals more than just economic momentum—it is a wake-up call. The EU is not in decline because it lacks values or a social model, but because it has not yet adapted its institutions and productivity to the realities of global competition. A Europe that finds its voice again must position itself as a new pole of attraction—not through confrontation, but by refining its own model of resilient innovation.

There are some certainties: The EU will never launch an invasion against a neighbor, as Russia did. No European leader will suggest annexing a 28th country (if anything, the challenge is managing a growing queue of applicants—nine at last count). Europe remains one of the last places where freedom of expression thrives—even more so now that such freedoms face challenges on American campuses. And here, getting sick doesn’t usually mean going bankrupt. Sending your child to a top university doesn’t necessarily require a mountain of debt—some of Europe’s best business schools are publicly funded.

Europe’s Welfare Paradox: Efficient and Humane

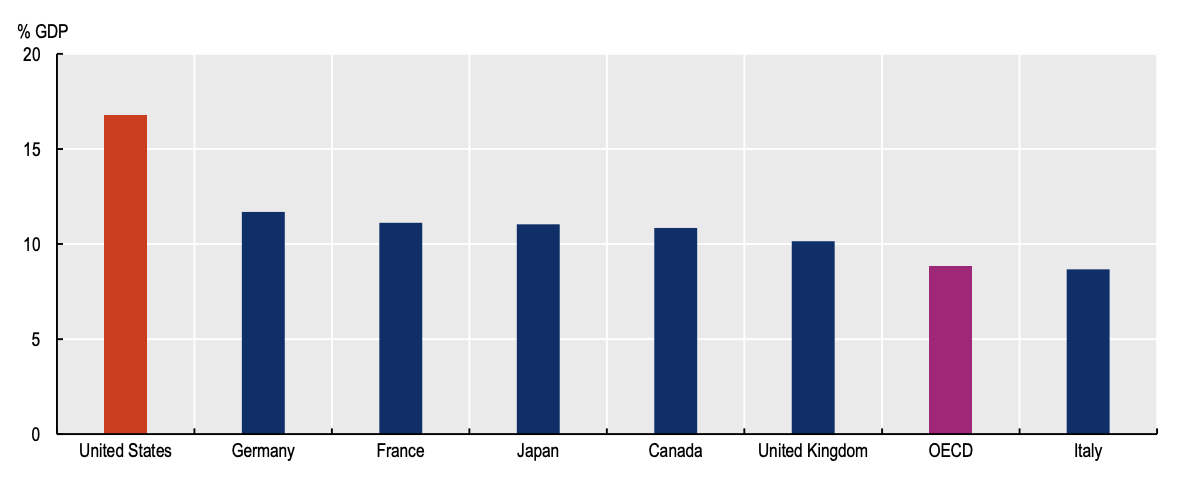

One of the great strengths of the European model is its commitment to universal access to health care. While often criticized for bureaucracy or waiting lists, the system offers a remarkable balance of quality, cost control, and inclusiveness. The data speak clearly when we compare public health spending across OECD countries.

Figure 2. Health spending as a share of GDP (2019)

The United States allocates over 17% of its GDP to healthcare, more than any other OECD country. In contrast, European countries like Italy, the UK, and France spend between 8% and 11%, while still offering universal coverage. (Source: OECD, (2022)).

This contrast challenges the idea that quality services must come at exorbitant costs. Europe’s ability to deliver essential public goods at a fraction of the U.S. cost shows that efficiency and equity are not mutually exclusive. In fact, they may be mutually reinforcing—if backed by smart investment and digital modernization.

Still, we cannot afford to let these strengths lull us into complacency. Europe has lost the race to build the global digital platforms that now shape how people communicate, think, and interact. This loss isn’t just about economic value—it’s about power and the ability to choose. In countries like Italy, birth rates are so low that statisticians are beginning to ponder the once-unthinkable disappearance of historic peoples. And while panic serves no one, Europe’s economy remains especially vulnerable to the whims of global trade tensions.

The real danger lies in the simplistic dichotomy often presented to us: Europe’s “slowness” versus America’s volatile speed. Innovation and equity, democracy and efficiency—why must these always be seen in opposition?

There must be a third way. Between the image of Europe as a Sleeping Beauty and America as a ravenous unicorn, we should recall that it was “creative madness” that once made this continent—especially places like Florence and Rotterdam—the best place to seek personal happiness. Europe is the continent that has reinvented itself, again and again.

Now, the challenge is to finally enter the 21st century—without forgetting who we are.

References

ANSA, (2025). Nascite in calo in Italia, fecondità ai minimi storici. Link.

European Commission, (2025). Commission launches new cybersecurity blueprint to enhance EU cyber crisis coordination. Shaping Europe’s Digital Future. Link.

IMF, (2024). World Economic Outlook: GDP based on PPP, share of world. Link.

OECD, (2022). Understanding differences in health expenditure between the United States and OECD countries. Organisation for Economic Co-operation and Development. Link.

The Economist, (2025). Europe cannot fathom what Trumpian America wants from it. Link.